Customs Declarations Made Simple, Fast & Fully Compliant

Welcome to Tax2Cargo — your trusted link between trade and HMRC. We help SMEs, freight forwarders, eCommerce sellers, importers, and exporters clear goods quickly and compliantly through UK borders. Whether you ship daily or occasionally, our expert-driven service ensures every customs declaration is done right — the first time.

Features

What you get with Tax2Cargo

The AI Customs Declaration Platform

AI Enabled

Use of AI to fill in declarations (automated). AI allows assistance in both conversational and agentic modes

HMRC-aligned, compliance-first architecture

HMRC-Ready Architecture – Built to mirror HMRC processes, ensuring 100% compatibility

Self-service declarations

Empower your team to create, monitor, and manage customs declarations independently. With built-in support for: Digital File Uploads, Ad-Hoc Reporting. Instructions on how to pay VAT and duty

Guided wizards & smart templates

Our intuitive, step-by-step wizards adapt to your shipment’s requirements - only asking what is relevant. Preconfigured templates ensure accuracy and save hours of repetitive work

Ability to resubmit declarations

Our platform allows resubmit and replay of declerations to facilitate speed and accuracy in submissions

Real-time tracking and control

Stay in control with real-time progress tracking for every declaration. Instantly see where each filing stands, get automatic notifications, and manage everything from a single dashboard

Demo and Portal environments available

Ability to explore the Demo environment with full features prior to selecting a subscription plan to utilise the live environment

Automation and bulk upload

Bulk upload of declarations from CSV files

Secure, cloud-native platform

Cloud first and AI first platform for import and export declaration submissions

24/7 expert support & training

Subscription based support options available, manuals and training provided.

Declarations Filled in by AI

Plain Language Input

Describe your shipment in everyday language, and AI translates it into structured HMRC declaration fields.

Smart Field Mapping

System auto-fills the correct codes, values, and classifications based on your description

Interactive Validation

Review AI-suggested entries, approve them, or request changes instantly.

Seamless UI Handoff

Switch back to the interface anytime to refine details or complete missing fields.

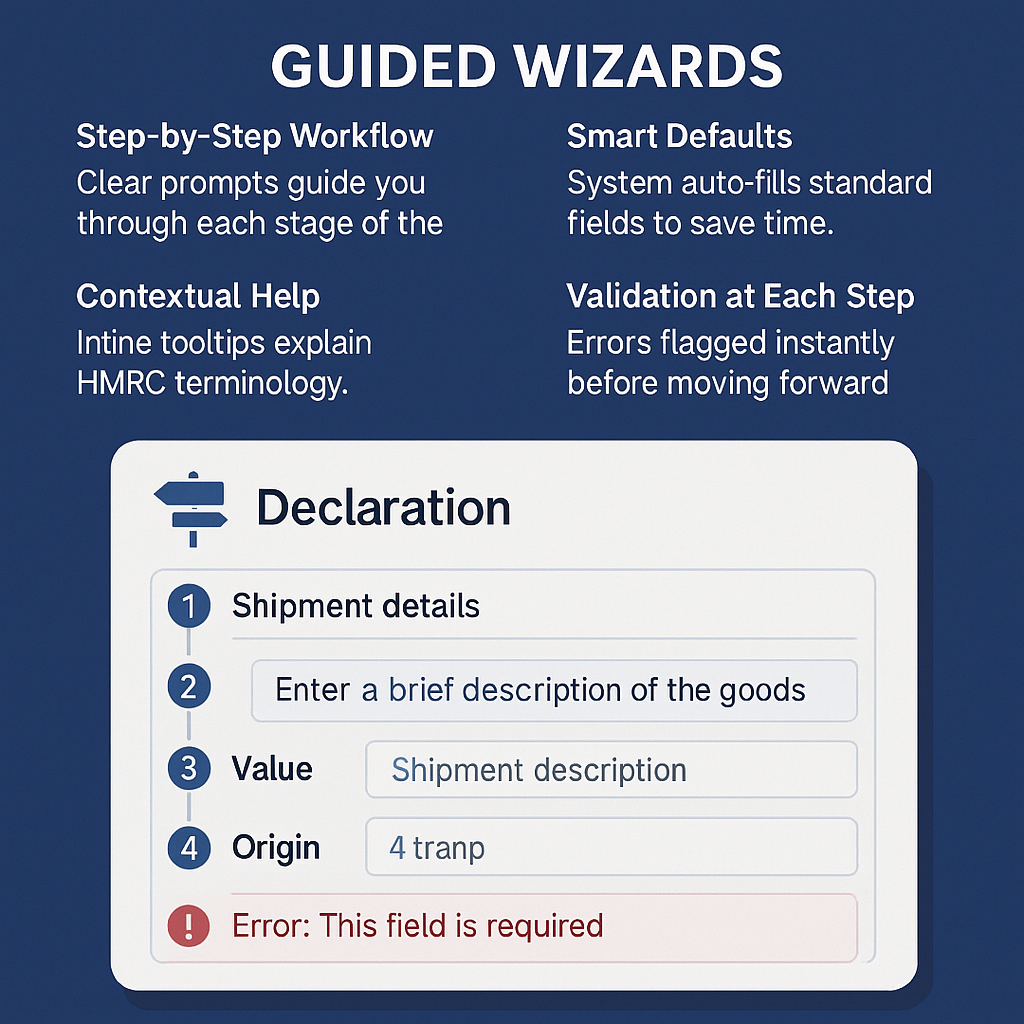

Guided Wizards

Step-by-Step Workflow

Clear prompts guide you through each stage of the declaration.

Smart Defaults

System auto-fills standard fields to save time.

Contextual Help

Inline tooltips explain HMRC terminology.

Validation at Each Step.

Errors flagged instantly before moving forward.

Compliance-First Architecture

Audit-Ready Records.

Full declaration history with immutable logs for audits.

Data Security by Design.

Built with enterprise-grade encryption and access controls.

GDPR & UK Data Standards.

Fully compliant with UK/EU data protection requirements.

FAQs

General Questions

What is Tax2Cargo?

Tax2Cargo is a UK-based customs declaration platform working with HMRC. We help importers, exporters, and agents complete and submit customs declarations quickly, accurately, and affordably using our AI-powered system.

Do you support import declarations with the Customs Declarations Service (CDS)?

Yes. We fully support import declarations on CDS in compliance with HMRC requirements.

Do you support export declarations with the Customs Declarations Service (CDS)?

Yes. Our platform also supports export declarations on CDS, with dedicated screens and guidance to make the process simple.

Do you support different customs systems?

Yes. Tax2Cargo is built to integrate with CDS and adapt to ongoing HMRC changes. As systems evolve, our platform updates automatically to keep you compliant.

How long does it take to sign up and create a new account?

The sign-up process takes only a few minutes. Once registered, you can immediately start preparing and submitting declarations.

FAQs

Platform Features

How does the platform assist in the filing process?

Tax2Cargo uses AI to fill in declarations automatically and an AI assistant to answer your questions. As well as securing a seamless User Interface UI experience. You’ll also find short video guides, easy-to-use screens, and helpful on-screen notifications.

What if I make a mistake in my declaration?

You can use our tool to quickly correct errors before submission. Our system also alerts you to common mistakes. You can make an amendment declaration to quickly correct errors before submission. Alternatively, you can choose to save the declaration before submitting so you can revisit it later, or cancel the declaration and submit a new one.

Can I save and reuse past declarations?

Yes. You have access to a full history of past submissions, and you can clone and resend any declaration to save time.

Can I store my contacts and commodity codes?

Yes. You can save and reuse your list of contacts, suppliers, and frequently used commodities, which makes repeat declarations faster.

Can I manage certifications and supporting documents?

Yes. Tax2Cargo includes a certification/document management system so you can upload, attach, and reuse compliance documents.

Does the platform generate reports?

Yes. You can create customer reports, submission logs, and audit records to meet business and compliance needs.

Is there an audit trail of submitted declarations?

Yes. Every submission includes a detailed audit log for compliance and inspections.

Do I get updates about my submissions?

Yes. You’ll receive real-time on-screen notifications about declaration and subscription status.

Ready to Get Started?

Join us to see even more innovation in the Declaration space Kon